What are the "choices" domestic structural and interior materials? Differentiation through collaboration with building material manufacturers and designers is the key to growth. Differentiation through collaboration with building material manufacturers and designers is the key to growth

Updated by Sogo Kato on August 13, 2025, 8:15 PM JST

Sougo KATO

Leaf Rain Co.

After working for a financial institution researching companies in the high-tech field, he worked as a supervisor at a landscape construction site before setting up his own business. He is interested in the materials industry, renewable energy, and wood utilization, and in recent years he has been writing about the forestry industry. With his experience of working in the forests in the past, he aims to write articles that explore the connection between the realities of the field and the industrial structure.

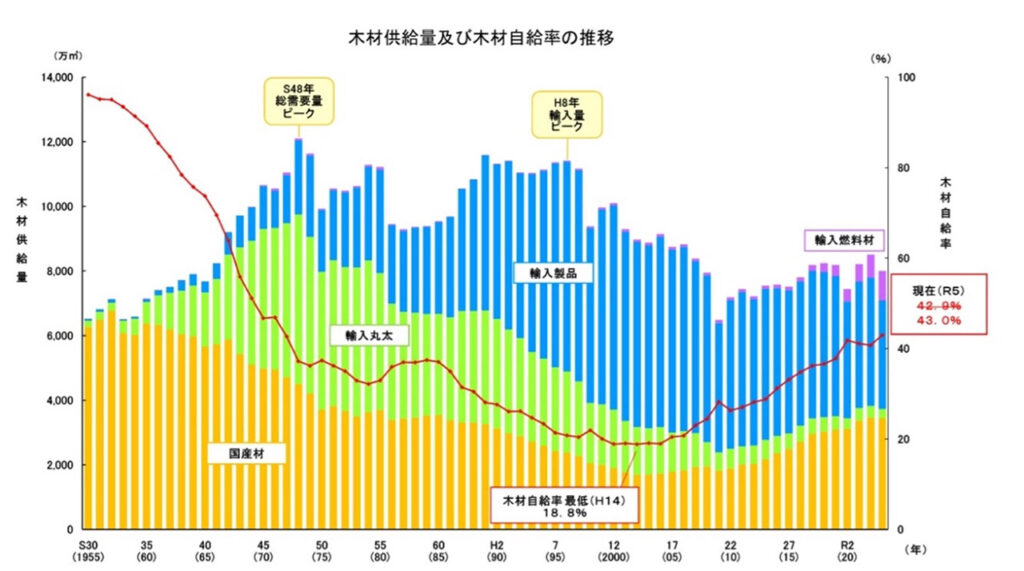

Total demand for lumber has been on a long-term downtrend, and in particular, construction lumber, the main use for domestic lumber, is feared to shrink due to the number of single-family housing starts and demographic trends. On the other hand, the self-sufficiency rate of domestic timber will rise to 43.0% in 2023, driven by the improved profitability of the forestry industry due to the expansion of woody biomass demand that began around 2014, and more recently by demand to replace soaring import timber prices due to the wood shock and yen depreciation. Although the absolute volume of supply and demand has not grown significantly, domestic lumber has regained competitiveness and production is on the rise.

However, external factors such as the weak yen and geopolitical risks are transitory from a medium- to long-term perspective, and the key to further sustainable development will be downstream industries, particularly the structural materials and interior building materials industries. These industries experienced a price rebound after the Wood Shock, and their profitability has been deteriorating due to the decline in the number of newly built houses. Currently, these industries are moving away from dependence on new detached houses and are focusing on expanding into remodeling and nonresidential construction. In addition, the growth of nonresidential wood construction is also attracting attention due to the government's policy of promoting wood in buildings.

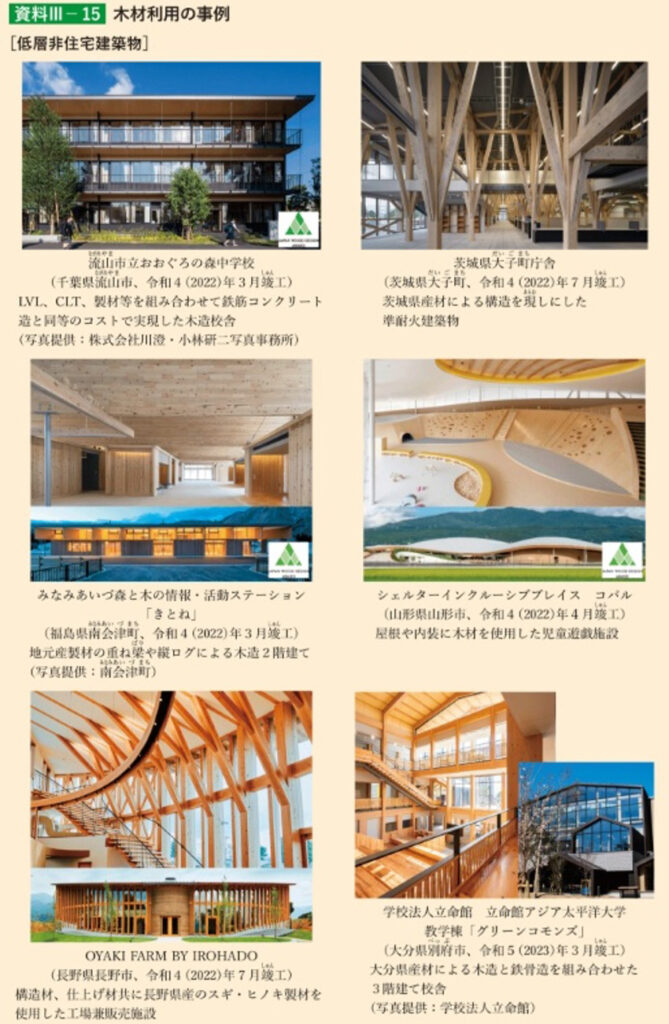

In the structural materials industry, demand for structural materials, including laminated wood, is expanding in the non-housing sector as the Building Standards Law is being revised to allow wood construction for buildings of a certain size, such as schools, nursery schools, welfare facilities, and commercial buildings.

Fire resistance, structural strength, and durability are strictly required for non-housing construction, and JAS certification is generally required for the laminated timbers used. Conventionally, imported laminated wood has been considered superior in terms of cost and stable supply for non-housing applications, and there have been structural hurdles to the use of domestic lumber, especially regional lumber.

The timber industry has a structure of local production for local consumption, and in many regions, small and medium-sized sawmills supply products that take advantage of local resources. However, because JAS certification involves high capital investment and management costs, it is a significant burden for small and medium-sized sawmills, and as a result, they have difficulty utilizing the certification for medium-scale construction.

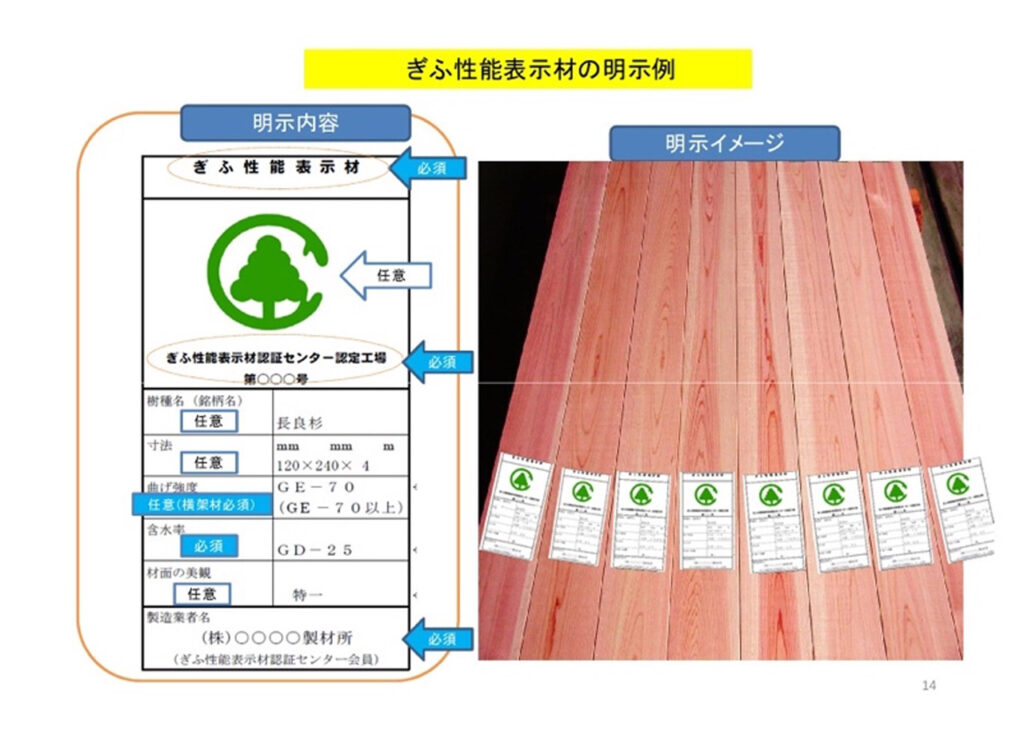

In response to this issue, Gifu Prefecture has been promoting its own initiatives. In Gifu, where forest resources are abundant and there are many wood processing companies, a system has been established that allows small and medium-sized companies that have not yet obtained JAS certification to supply wood for construction purposes as long as they can prove a certain level of performance. Specifically, it is called the "Gifu Performance Indication Lumber System," under which third-party organizations measure and indicate physical properties such as moisture content, Young's modulus, and strength, to ensure reliability equivalent to that of JAS-certified lumber.

This system has enabled a cycle in which local wood is handled by local processors and used for local construction in Gifu Prefecture, even for non-residential buildings. While other prefectures have no system in place and are forced to rely on JAS-certified lumber from major companies, Gifu's government, industry associations, and designers are working together to create a unique regional path through a system and creative distribution. This is a good example of how institutional design, rather than mere technical measures, can support the sustainability of wooden construction.

On the other hand, residential building materials manufacturers are under pressure to shift away from the traditional mass-supply model for detached houses. The common direction can be summed up in three key points: "entering the non-housing market," "strengthening support for remodeling," and "shifting to functional, high-value-added products.

In the non-housing sector, a certain level of demand is expected from hospitals, nursing care facilities, schools, etc. Interior building materials with safety and barrier-free features, such as Eidai Sangyo's "Safe Care Plus" and Noda's "Carecist" are being introduced. For the remodeling market, construction-saving products are also being developed. Wood One's "Slim Side Panel," for example, allows shelves to be installed regardless of whether or not there is a base, contributing to more efficient on-site work.

Looking over these developments, the trends in interior building materials can be summarized in four areas: "construction saving," "safety and barrier-free," "high durability," and "high design and industrialization. In particular, the trend toward panels and units that pursue both design and workability is accelerating, and building materials are strongly required to have a level of perfection as industrial products.

In this market environment, the presence of domestic lumber in interior applications is still seen as limited. While sensory value and storytelling qualities are highly valued, physical properties such as warpage, high knotting, and softness, as well as inconsistent dimensional modules and high construction labor are barriers to practical application.

It would not be realistic for domestic timber to compete directly in the field of building materials for general distribution, where cost efficiency and standardization are required. However, domestic timber could play a complementary role to the trend toward high value-added products by building material manufacturers, in the direction of finding value in the texture and story of the materials. What is important is the shift to "semi-industrial products" that are easy to handle, and a strategy of differentiation through collaboration with building material manufacturers and designers will be the key to growth.

For example, flooring that uses Japanese cypress for the base and laminated hardwood laminate is a good example of a product with a good balance of durability, design, and storytelling. The future standard will be "product design based on on-site ideas," including pre-cutting and modularization to reduce construction work, as well as non-housing development.

Domestic timber should not be limited to "appealing to the senses," but should be developed into a "practical option" for urban living. This is a realistic starting point for the Japanese lumber industry to advance to the next stage.

The utilization of domestic timber has both challenges and possibilities according to its use and industrial structure. For structural materials, it will continue to be important to develop a system and devise distribution methods through collaboration among local governments, timber manufacturers, and the forestry industry. In the case of interior materials, it will be necessary to respond with precision and workability as "semi-industrial products" in accordance with the timing of remodeling and the expansion of products for non-residential use.

The forestry and lumber industries are expected to translate the attractiveness of materials into the architectural needs of cities, and through collaboration, to translate them into tangible value. Reconnecting the system with the field, and the materials with the city, will be a realistic step toward making domestic timber take root in society. (Sogo Kato, Forestry Writer, Leaf Rain Co.)